UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a‑12 |

| NORTHSTAR HEALTHCARE INCOME, INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): x No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

To the Stockholders of NorthStar Healthcare Income, Inc.:

It is our pleasure to invite you to the 20172020 annual meeting of stockholders of NorthStar Healthcare Income, Inc., a Maryland corporation. The annual meeting will be held at 399Alston & Bird LLP, 90 Park Avenue, 18th Floor, New York, New York 10022NY 10016 on June 22, 2017,18, 2020, beginning at 9:00 a.m., local time. Because of the uncertainties surrounding the impact of the COVID-19 pandemic, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance of the annual meeting, and details on how to participate in the webcast will be set forth in a press release issued by NorthStar Healthcare Income, Inc. and available at www.NorthStarHealthcareReit.com.

The enclosed materials include a notice of meeting, a proxy statement, proxy card, self-addressed envelope and our Annual Report to Stockholders for the fiscal year ended December 31, 2016.2019.

It is important that your shares be represented at the annual meeting regardless of the size of your securities holdings. Whether or not you plan to attend the annual meeting in person, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone or Internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these three methods. If you determine to mail us your proxy, please complete, date and sign the proxy card and return it promptly in the envelope provided, which requires no postage if mailed in the United States. If you are the record holder of your shares and you attend the annual meeting, you may withdraw your proxy and vote in person, if you so choose.

We look forward to receiving your proxy and seeing you at the meeting.

| Sincerely, | Sincerely, |

| /s/ | /s/ RONALD J. JEANNEAULT |

Ronald J. Jeanneault | |

| Chief Executive Officer, President and | |

| April | |

| New York, New York | |

____________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 22, 201718, 2020

____________________________

To the Stockholders of NorthStar Healthcare Income, Inc.:

The 20172020 annual meeting of stockholders, or the annual meeting, of NorthStar Healthcare Income, Inc., a Maryland corporation, or the Company, will be held at 399Alston & Bird LLP, 90 Park Avenue, 18th15th Floor, New York, New York 10022NY 10016 on June 22, 2017,18, 2020, beginning at 9:00 a.m., local time. Because of the uncertainties surrounding the impact of the COVID-19 pandemic, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance of the annual meeting, and details on how to participate in the webcast will be set forth in a press release issued by the Company and available at www.NorthStarHealthcareReit.com. The matters to be considered and voted upon by stockholders at the annual meeting, which are described in detail in the accompanying proxy statement, are:

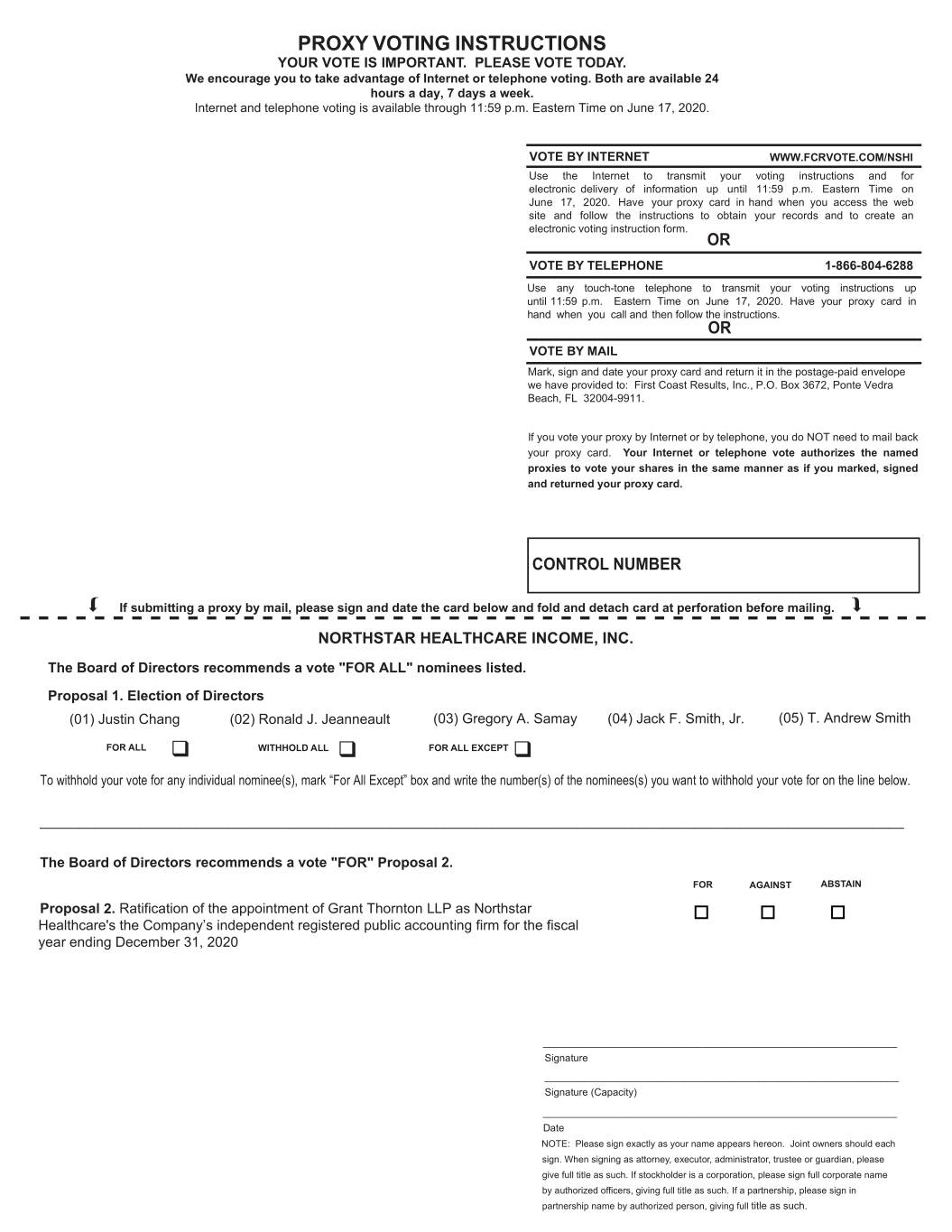

| 1) | a proposal to elect as directors the five individuals nominated by our Board of Directors as set forth in the accompanying proxy statement, each to serve until the |

| 2) | a proposal to ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| any other business that may properly come before the annual meeting or any postponement or adjournment of the annual meeting. |

This notice is accompanied by the Company’s proxy statement, proxy card, self-addressed envelope and our Annual Report to Stockholders for the fiscal year ended December 31, 2016.2019. This notice is being mailed to you on or about April 28, 2017.17, 2020.

Stockholders of record at the close of business on April 11, 20178, 2020 will be entitled to notice of and to vote at the annual meeting and any postponement or adjournment thereof. Whether or not you plan to attend the annual meeting in person, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone or Internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these methods. If you determine to mail us your proxy, please complete, date and sign the proxy card as soon as possible and return it promptly in the envelope provided, which requires no postage if mailed in the United States. Your vote is very important. Your immediate response will help avoid potential delays and may save us significant expenses associated with soliciting stockholder votes. If you are the record holder of your shares and you attend the annual meeting, you may withdraw your proxy and vote in person, if you so choose.

| By Order of the Board of Directors, | |

/s/ ANN B. HARRINGTON Ann B. Harrington General Counsel and Secretary | |

April 28, 201716, 2020

New York, New York

NorthStar Healthcare Income, Inc.

New York, New York 10022

(212) 547-2600

____________________________

PROXY STATEMENT

____________________________

FOR THE 20172020 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 22, 201718, 2020

TABLE OF CONTENTS

| Page | |

i

GENERAL INFORMATION ABOUT THE MEETING

This proxy statement and the accompanying proxy card and Notice of Annual Meeting of Stockholders are provided in connection with the solicitation of proxies by and on behalf of the board of directors, or our Board, of NorthStar Healthcare Income, Inc., a Maryland corporation, for use at the 20172020 annual meeting of stockholders to be held on June 22, 2017,18, 2020, beginning at 9:00 a.m., local time, and any postponements or adjournments thereof. “We,Because of the uncertainties surrounding the impact of the COVID-19 pandemic, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance of the annual meeting, and details on how to participate in the webcast will be set forth in a press release issued by the Company and available at www.NorthStarHealthcareReit.com. “We,” “our,” “us” and “the Company” each refers to NorthStar Healthcare Income, Inc. We conduct substantially all of our operations and make our investments through our operating partnership, of which we are the sole general partner. References to our operating partnership refer to NorthStar Healthcare Income Operating Partnership, LP.

We were formed to acquire, originate and asset manage a diversified portfolio of equity, debt and securities investments in healthcare real estate, directly or through joint ventures, with a focus on the mid-acuity senior housing sector, which we define as assisted living, memory care, skilled nursing and independent living facilities and continuing care retirement communities. We also invest in other healthcare property types, including medical office buildings, hospitals, rehabilitation facilities and ancillary services businesses.

We are externally managed and have no employees. Prior to January 11, 2017, we were managedWe are sponsored by an affiliateColony Capital, Inc. (NYSE: CLNY), or Colony Capital or our Sponsor, which was formed as a result of the mergers of NorthStar Asset Management Group Inc. (NYSE: NSAM), or NSAM. Effective January 10, 2017, NSAM, completed its previously announced mergerour prior sponsor, with a predecessor of Colony Capital Inc., or Colony,and NorthStar Realty Finance Corp., or NorthStar Realty, and Colony NorthStar, Inc., or Colony NorthStar, a wholly-owned subsidiary of NSAM, which we refer to asin January 2017. Following the mergers, with Colony NorthStar surviving the mergers and succeeding NSAM as our Sponsor. As a result of the mergers, our SponsorCapital became an internally-managed equity real estate investment trust, or REIT, with a diversified real estate and investment management platformplatform. Colony Capital manages capital on behalf of its stockholders, as well as institutional and publicly-traded on the New York Stock Exchange, or NYSE,retail investors in private funds, non-traded and traded REITs and registered investment companies. As of December 31, 2019, Colony Capital had approximately $49.0 billion of assets under the ticker symbol “CLNS”. In addition, following the mergers,management, including Colony Capital’s balance sheet investments and third-party managed investments. Our advisor, CNI NSHC Advisors, LLC, (formerly NSAM J-NSHC Ltd), an affiliate of NSAM, or our Advisor, becameis a subsidiary of Colony NorthStar. Our AdvisorCapital and manages our day-to-day operations pursuant to an advisory agreement.

The mailing address of our executive office is 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022. This proxy statement, the accompanying proxy card and the Notice of Annual Meeting of Stockholders are first being mailed to holders of our common stock on or about April 28, 2017.17, 2020. Stockholders of record at the close of business on April 11, 20178, 2020 are entitled to notice of and to vote at the annual meeting. Our common stock is the only security entitled to vote at the annual meeting. In this proxy statement, we refer to the shares of our common stock entitled to vote at the annual meeting as our voting securities. Along with this proxy statement, we are also sending our Annual Report to Stockholders for the fiscal year ended December 31, 2016.2019.

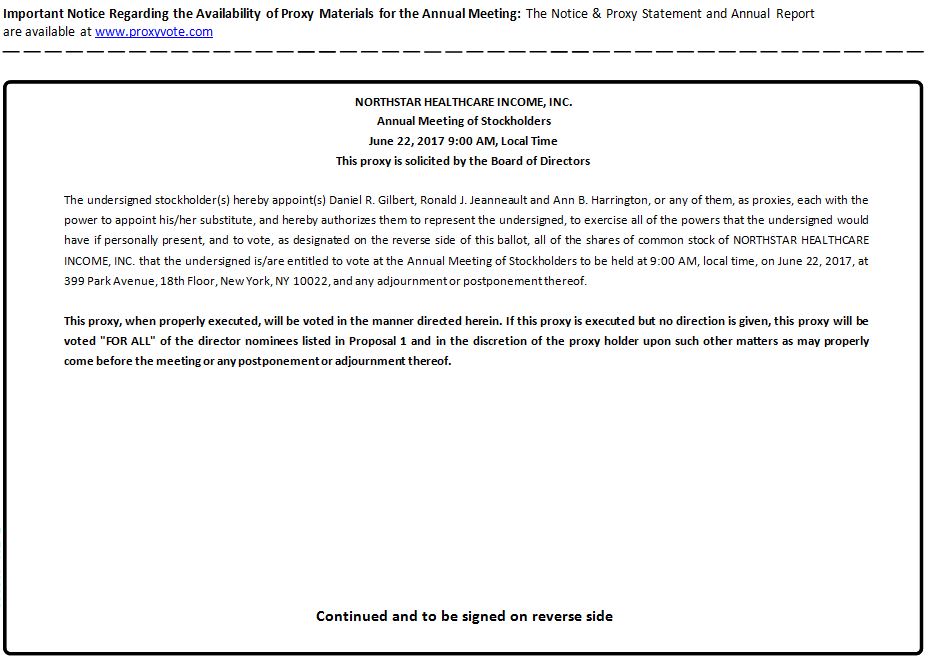

When you submit your proxy, you are authorizing a proxy to vote your shares of common stock at the annual meeting as you instruct, unless you return the proxy with no instruction. In this case, the individuals designated as proxies to vote your shares of common stock at the annual meeting, Daniel R. Gilbert,Justin Chang, Ronald J. Jeanneault and Ann B. Harrington, or any of them, will vote FOR the election of each of the five director nominees.nominees and FOR the ratification of Grant Thornton LLP, or Grant Thornton, as our independent registered public accounting firm for the fiscal year ending December 31, 2020. As of the date of this proxy statement, management has no knowledge of any business that will be presented for consideration at the annual meeting and that would be required to be set forth in this proxy statement or the related proxy card other than the matters set forth in the Notice of Annual Meeting of Stockholders. If any other matter is properly presented at the annual meeting for consideration, the persons named in the enclosed proxy card and acting thereunder will vote in accordance with their discretion on any such matter.

Grant Thornton, LLP, or Grant Thornton, an independent registered public accounting firm, has provided services to us during the past fiscal year, which included the examination of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016,2019, review of our quarterly reports and review of registration statements and filings with the Securities and Exchange Commission, or SEC. As of the date of this proxy statement, we have not selected an independent registered public accounting firm for the year ending December 31, 2017. A representative of Grant Thornton is expected to be present at the annual meeting, will be available to respond to appropriate questions from our stockholders and will be given an opportunity to make a statement if he or she desires to do so.

Matters to be Considered and Voted Upon at the Annual Meeting

At the annual meeting, our stockholders will consider and vote upon:

| 1) | a proposal to elect as directors the five individuals nominated by our Board as set forth in this proxy statement, each to serve until the |

1

| 2) | a proposal to ratify the appointment of Grant Thornton as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| any other business that may properly come before the annual meeting or any postponement or adjournment of the annual meeting. |

Solicitation of Proxies

The enclosed proxy is solicited by and on behalf of our Board. The expense of preparing, printing and mailing this proxy statement and the proxies solicited hereby will be borne by us. In addition to the solicitation of proxies by mail, proxies may be solicited by directors and officers, without additional remuneration, by personal interview, telephone, electronic communications or otherwise. We will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our common stock held of record as of the close of business on April 11, 20178, 2020 and will reimburse them for their reasonable out-of-pocket expenses for forwarding the materials.

We have retained Broadridge Investor Communication Solutions,D.F. King & Co., Inc., or Broadridge,D.F. King, to assist us in the distribution of proxy materials and the solicitation of proxies. We estimate that we will pay BroadridgeD.F. King a fee of approximately $17,500$10,000 for proxy solicitation services provided for us, plus reasonable out-of-pocket expenses incurred in connection with their services.

Stockholders Entitled To Vote

As of the close of business on April 11, 2017,8, 2020, there were 186,562,177189,191,862 shares of our common stock outstanding and entitled to vote. Each share of our common stock entitles the holder to one vote. Stockholders of record at the close of business on April 11, 20178, 2020 are entitled to notice of and to vote at the annual meeting or any postponement or adjournment thereof.

Abstentions and Broker Non-Votes

If you hold your shares in street name and do not provide voting instructions to your bank, broker or other nominee, proxies submitted by a broker for your shares will be considered to be “broker non-votes” with respect to any proposal on which your bank, broker or other nominee does not have discretionary authority to vote. A broker non-vote is a vote that is not cast on a non-routine matter because the shares entitled to cast the vote are held in street name, the broker lacks discretionary authority to vote the shares and the broker has not received voting instructions from the beneficial owner. Your bank, broker or other nominee does not have discretionary authority to vote your shares for Proposal No. 1, the election of directors. AsYour bank, broker or other nominee does have discretionary authority to vote your shares for Proposal No. 1 is2, the only matter anticipated to be considered atratification of the annual meeting, we do not expect any broker non-votes atselection of Grant Thornton as our independent registered public accounting firm for the annual meeting. We also do not expect there to be any abstentions because that is not a voting option with respect to the election of directors.fiscal year ending December 31, 2020. Abstentions and broker non-votes, if any, will be counted as present at the annual meeting for the purpose of determining a quorum.

Required Quorum/Vote

A quorum will be present if stockholders entitled to cast at least 50% of all the votes entitled to be cast at the annual meeting on any matter are present, in person or by proxy. If you hold your shares in your own name as holder of record and authorize your proxy by mail, telephone or Internet or attend the annual meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. If you hold your shares in street name and provide your broker with voting instructions, your shares will also be counted for the purpose of determining whether there is a quorum. If a quorum is not present, the annual meeting may be adjourned by the chairman of the annual meeting to a date not more than 120 days after the original record date without notice other than announcement at the annual meeting.

Election of the director nominees named in Proposal No. 1 requires the affirmative vote of the holders of a majority of the shares present in person or by proxy at the annual meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of each of the director nominees named in Proposal No. 1. Votes may be cast in favor of, or withheld with respect to, all of the director nominees, or any one or more of them. A vote “withheld” or a broker non-vote, if any, will have the same effect as a vote against that nominee.

Ratification of the selection of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2020, as specified in Proposal No. 2, requires the affirmative vote of a majority of the votes cast on the proposal at the annual meeting. If this selection is not ratified by holders of our voting securities, our Board’s Audit Committee, or our Audit Committee, may, but need not, reconsider its appointment and endorsement. Abstentions, if any, will not be counted as having been cast and will have no effect on the outcome of the vote for this proposal. Broker non-votes will not arise in connection with, and will have no effect on the outcome of, Proposal No. 2 because brokers may vote in their discretion on behalf of clients who have not furnished voting instructions. Even if the selection is ratified, our Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company.

2

If the enclosed proxy is properly executed and returned to us in time to be voted at the annual meeting, it will be voted as specified on the proxy unless it is properly revoked prior thereto. If no specification is made on the proxy as to any one or more of the proposals, the shares of our voting securities represented by the proxy will be voted as follows:

| 1) | FOR the election of the five individuals nominated by our Board as set forth in this proxy statement, each to serve until the |

| 2) | FOR the ratification of the appointment of Grant Thornton as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| in the discretion of the proxy holder, on any other business that properly comes before the annual meeting or any postponement or adjournment thereof. |

As of the date of this proxy statement, we are not aware of any other matter to be raised at the annual meeting.

Voting

If you hold your shares of our voting securities in your own name as a holder of record, you may instruct the proxies to vote your shares by signing, dating and mailing the proxy card in the postage-paid envelope provided. In addition, you may authorize a proxy to vote your shares of our voting securities by either visiting ourthe electronic voting site at www.proxyvote.com,set forth on the proxy card or voting instruction form sent to you, by calling our toll-freethe toll free number set forth on the proxy card or voting number at 1-800-690-6903instruction form sent to you or you may vote your shares in person at the annual meeting. Your immediate response will help avoid potential delays and may save us significant expenses associated with soliciting stockholder votes.

If your shares of our voting securities are held on your behalf by a broker, bank or other nominee, you will receive instructions from such individual or entity that you must follow in order to have your shares voted at the annual meeting. If your shares are not registered in your own name and you plan to vote your shares in person at the annual meeting, you should contact your broker, bank or other nominee to obtain a legal proxy card and bring it to the annual meeting in order to vote.

If you have questions about the proposals or would like additional copies of the proxy statement, please contact our proxy solicitor, Broadridge,D.F. King, at 1-888-991-1290.1-866-207-2239.

Right to Revoke Proxy

If you hold shares of our voting securities in your own name as a holder of record, you may revoke your proxy through any of the following methods:

send written notice of revocation, prior to the date of the annual meeting, to our Secretary, at NorthStar Healthcare Income, Inc., 590 Madison Avenue, 34th Floor, New York, New York 10022; |

sign and mail a new, later-dated proxy card to our Secretary at the address specified above that is received prior to the date of the annual meeting;

visit our electronic voting site at www.proxyvote.com;

set forth on the proxy card or voting instruction form sent to you and follow the online instructions;call our toll-freethe toll free number set forth on the proxy card or voting number at 1-800-690-6903instruction form sent to you and follow the instructions provided; or

attend the annual meeting and vote your shares in person, although attendance at the annual meeting will not by itself constitute revocation of a proxy.

Only the most recent proxy vote will be counted and all others will be disregarded notwithstanding the method by which the proxy was authorized. If shares of our voting securities are held on your behalf by a broker, bank or other nominee, you must contact it to receive instructions as to how you may revoke your proxy.

Copies of Annual Report to Stockholders

A copy of our Annual Report to Stockholders for the fiscal year ended December 31, 20162019 is being mailed to stockholders entitled to vote at the annual meeting with these proxy materials and is also available without charge to stockholders upon written request to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel.

3

Annual Report and Quarterly Reports

We make available free of charge through our website at www.northstarsecurities.com/healthcarewww.NorthStarHealthcareReit.com under the heading “Investor Relations—SEC Filings” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such materials are electronically filed with or furnished to the SEC. Further, we will provide, without charge to each stockholder upon written request, a copy of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports. Requests for copies should be addressed to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel. Copies may also be accessed electronically by means of the SEC’s home page, at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You also may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference facilities.

Householding Information

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we deliver only one copy of our Annual Report to Stockholders for the fiscal year ended December 31, 20162019 to multiple stockholders with the same last name and address, or if we reasonably believe they are members of the same family residing at the same address, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Each stockholder will continue to receive a separate proxy card or voting instruction card.

If you participate in householding and wish to receive a separate copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2016,2019, please request a copy in writing from NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel or by phone by calling 212-547-2600 and a copy will be provided to you promptly.

If you do not wish to continue participating in householding and prefer to receive separate copies of future annual reports to stockholders and other stockholder communications, notify our General Counsel in writing at the following address: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, or by phone by calling 212-547-2600.

If you are a stockholder who received multiple copies of our proxy materials or our Annual Report to Stockholders for the fiscal year ended December 31, 2016,2019, you may request householding by contacting us in the same manner as above.

Voting Results

Confidentiality of Voting

We will keep all proxies, ballots and voting tabulations confidential. We will permit only our Inspector of Election to examine these documents, except as necessary to meet applicable legal requirements.

Recommendations of our Board

Our Board recommends a vote:

| 1) | FOR the election of the five individuals nominated by our Board as set forth in this proxy statement, each to serve until the |

| 2) | FOR the ratification of the appointment of Grant Thornton as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020. |

4

BOARD OF DIRECTORS

General

Our Board presently consists of five members. At the annual meeting, stockholders will vote on the election of Messrs. Daniel R. Gilbert, Robert C. Gatenio, DanielJustin Chang, Ronald J. Altobello,Jeanneault, Gregory A. Samay, and Jack F. Smith, Jr., and T. Andrew Smith for a term ending at the 20182021 annual meeting of stockholders and until their successors are duly elected and qualified.

The director nominees listed below are leaders in business and real estate and financial communities because of their intellectual acumen and analytic skills, strategic vision and their records of outstanding accomplishments over a period of decades. Each has been chosen to stand for re-election (or election in the case of Mr. T. Andrew Smith) in part because of his ability and willingness to understand our unique challenges, and evaluate and implement our strategies.

Set forth below is each director nominee’s name and age as of the date of this proxy statement and biographical information. Each of our director nominees currently serves on our Board and, except for Mr. T. Andrew Smith, was elected as a director by the stockholders at the 20162019 annual meeting of stockholders.

Current Directors Who are Nominees for Re-election

| Name | Age | |

| Gregory A. Samay | ||

| Jack F. Smith, Jr. | ||

| T. Andrew Smith | 60 | |

Consideration for Recommendation: Our Board believes that Mr. Gatenio’s understanding of the Company’s business strategy and operations given his role in building the healthcare platform across our Sponsor’s managed companies, having overseen acquisitions of healthcare investments for our Sponsor since 2013, and his priorChang’s extensive commercial real estate expertise, combined with his position overseeing certain strategic investments and finance experiencerelationships of our Sponsor, support his nomination to our Board.

Consideration for Recommendation: Our Board believes that Mr. Jeanneault’s knowledge of the Company’s business and decades of experience in public securities, gas and oil, mutual funds and private equity ventures. From September 1995 until October 2000, Mr. Altobello was the Chairman of Onex Food Services, Inc., a subsidiary of private equity investor Onex Corp., where he was responsiblehealthcare industry support his nomination to our Board.

5

Gregory A. Samay. Gregory A. Samay has been one of our independent directors and a member of our Audit Committee since June 2011. He has also been an independent trustee and member of the audit committee of RE Capital Fund since March 2016. Mr. Samay served as Chief Investment Officer for the Fairfax County Retirement Systems consisting of three public pension systems with a combined $6 billion of assets from July 2013 (having previously served as an Investment Officer since July 2011) to July 2016. Mr. Samay served as Executive Director and Chief Investment Officer for Arlington County Employees’ Retirement System, a $1.3 billion public pension plan, from August 2005 to September 2010. Mr. Samay served as Assistant Treasurer for YUM! Brands, Inc. (NYSE: YUM), a quick service restaurant company, from 2003 to 2005. From 1998 to 2002, he served as Vice President and Treasurer of Charles E. Smith Residential Realty, Inc., a publicly-traded REIT that merged with Archstone Communities of Denver in 2001 to form Archstone-Smith Trust, a publicly-traded REIT until acquired by Tishman Speyer and Lehman Brothers Holdings Inc. in October 2007. Mr. Samay served as Senior Manager, Capital Markets and Investments, for MCI Corporation from 1996 to 1998. From 1987 to 1996, he held various positions, progressing from Senior Financial Advisor-Corporate Treasury to Assistant Treasurer-Corporate Treasury, for COMSAT Corporation, a global telecommunications company. Mr. Samay is a National Association of Corporate Directors (NACD) Governance Fellow. The NACD Fellowship is a comprehensive and continuing education program of study in leading boardroom practices. Mr. Samay holds a Bachelor of Science in Engineering from Pennsylvania State University in University Park, Pennsylvania and a Master of Business Administration from the Darden School of Business, University of Virginia in Charlottesville, Virginia.

Consideration for Recommendation: Our Board believes that Mr. Samay’s experience directing investments for a large pension fund and serving in various capacities for public REITs supports his nomination to our Board.

Jack F. Smith, Jr. Jack F. Smith, Jr. has been one of our independent directors and the chairman and financial expert of our Audit Committee since June 2011. He has also been the lead independent trustee and chairman of the audit committee of NorthStar Corporate Income Fund since January 2016. Mr. Smith is also a member of the board of directors and chairman of the audit committee of NorthStar Income, a position he has held since January 2010. Mr. Smith was a partner with Deloitte & Touche LLP, or Deloitte & Touche, from June 1984 until August 2009. Subsequent to his retirement in 2009, Mr. Smith has engaged in investing in and management of personal real estate and other assets. During his tenure at Deloitte & Touche LLP, heHe served as the head of the firm’s real estate industry practice for Atlanta, Georgia and the Southeast from June 1996 to June 2007. Mr. Smith began his career as an accountant with Haskins and Sells (later Deloitte & Touche LLP) in 1973, where his responsibilities included audits, due diligence on acquisitions and mergers, business and accounting advice and assistance in problem resolution. During the course of his career, Mr. Smith has served clients of varying sizes in many different industries, including public and private REITs, real estate developers, merchant builders, real estate investment funds, real estate operating companies and hotels. Mr. Smith is a certified public accountant in both Georgia and Tennessee. Mr. Smith is a member of the Tennessee Technological University College of Business Foundation, the American Institute of Certified Public Accountants and the Tennessee Societyand Georgia Societies of Certified Public AccountantsAccountants. Subsequent to his retirement in 2009, Mr. Smith has engaged in investing in and the Georgia Societymanagement of Certified Public Accountants.personal real estate and other assets. Mr. Smith holds a Bachelor of Science in Accounting from Tennessee Technological University in Cookeville, Tennessee and a Master of Business Administration from Emory University in Atlanta, Georgia.University.

Consideration for Recommendation: Our Board believes that Mr. Smith’s 25 years of experience as a partner with Deloitte & Touche LLP and his service as the head of the firm’s real estate industry practice in Atlanta and the Southeast support his nomination to our Board.

T. Andrew Smith. T. Andrew Smithhas been one of our independent directors and a member of our Audit Committee since December 2019. Mr. Smith served as the Chief Executive Officer of Brookdale Senior Living, Inc. (NYSE: BKD) from February 2013 until February 2018, as President from March 2016 until February 2018, and as a member of the Board of Directors from June 2014 until February 2018. From October 2006 to February 2013, Mr. Smith served as Brookdale’s Executive Vice President, General Counsel and Secretary. In addition to his role in managing the company’s legal affairs, Mr. Smith was responsible for the management and oversight of the company’s corporate development functions (including mergers and acquisitions, and expansion and development activity); corporate finance (including capital structure, debt and lease transactions and lender/lessor relations); strategic planning; and risk management. Prior to joining Brookdale, Mr. Smith served as a member of Bass, Berry & Sims PLC’s corporate and securities group and as chair of the firm's healthcare group. Mr. Smith previously served as a member of the board of directors of the Nashville Health Care Council, Argentum and the National Investment Center for the Seniors Housing & Care Industry (NIC), and as a member of the executive board of the American Seniors Housing Association (ASHA). Mr. Smith received his Bachelor of Arts from Vanderbilt University and his Juris Doctor from Southern Methodist University School of Law.

Corporate Governance Profile

We are committed to good corporate governance practices and, as such, we have adopted a code of ethics and corporate governance guidelines discussed below.

6

Code of Ethics

We have adopted a code of ethics for the purpose of promoting honest and ethical conduct of our business, full disclosure in our filings with the SEC, compliance with applicable laws, governmental rules and regulations, prompt internal reporting of violations of, and accountability for adherence to, our code of ethics. Our code of ethics applies to our Chief Executive Officer, Chief Financial Officer, Treasurer and other senior financial officers performing similar functions and our Board, collectively referred to as our covered persons. We intend to maintain high standards of honest and ethical business practices and compliance with all laws and regulations applicable to our business. Among the areas addressed by our code of ethics are conflicts of interest, including improper benefits, outside financial interests, business arrangements with us, outside employment or activities with competitors, charitable, government and other outside business activities, family members working in the industry, corporate opportunities, offering and receiving entertainment, gifts and gratuities, protection and proper use of our assets, maintaining our books and records, internal accounting controls, improper influence on audits, record retention, the protection of our confidential information, trademarks, copyrights and other intellectual property, insider trading, fair dealing and interacting with the government. Our code of ethics is available on our website at www.northstarsecurities.com/healthcarewww.NorthStarHealthcareReit.com under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel. Within the time period required by the rules of the SEC, we will post on our website any amendment to, or waiver from, our code of ethics.

Corporate Governance Guidelines

We have adopted corporate governance guidelines to assist our Board in the exercise of its responsibilities. The corporate governance guidelines govern, among other things, Board composition, Board member qualifications, responsibilities and education, management succession and self-evaluation. A copy of our corporate governance guidelines may be found on our website at www.northstarsecurities.com/healthcarewww.NorthStarHealthcareReit.com under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel.

Hedging Policy

Our Board has not adopted, and we do not have, any specific practices or policies regarding the ability of our officers, our directors, the employees of our Sponsor and its affiliates, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities.

Our Audit Committee

Our Board has a separately designated standing Audit Committee and its primary function is to engage our independent registered public accounting firm and to assist our Board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to the stockholders and others, the system of internal controls which management has established and the audit and financial reporting process.

Our Audit Committee acts under a written charter adopted by our Board that sets forth the committee’s responsibilities and duties, as well as requirements for the committee’s composition and meetings. Under the Audit Committee charter, our Audit Committee will always be comprised solely of independent directors. A copy of the Audit Committee charter is available on our website at www.northstarsecurities.com/healthcarewww.NorthStarHealthcareReit.com under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel.

Our Audit Committee held seven meetings in 2016.2019. Each director then serving as a member of our Audit Committee attended at least 75% of the aggregate number of meetings of our Audit Committee.Committee, except for Mr. Altobello. Our Board has determined that each member of our Audit Committee is independent within the meaning of the applicable SEC rules. Even though our shares are not listed on the NYSE, our Board has also determined that each independent member of our Board is independent under the NYSE rules. The members of our Audit Committee are Messrs. Altobello, Samay, J. Smith and T. Smith. Our Board has determined that Mr. Jack F. Smith, who chairs our Audit Committee, is an “audit committee financial expert,” as that term is defined by the SEC.

The Audit Committee’s report on our financial statements for the fiscal year ended December 31, 20162019 is presented below under the heading “Audit Committee Report.”

7

Compensation Committee Interlocks and Insider Participation

We currently do not have a compensation committee of our Board because we do not pay any compensation to our officers. Our independent directors participate in the consideration of independent director compensation. There are no interlocks or insider participation as to compensation decisions required to be disclosed pursuant to SEC regulations.

Director Independence

The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain specified criteria, our Board must conclude that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Although our shares are not listed on the NYSE or any other national securities exchange, our Board has affirmatively determined that all of the members of our Board, except Messrs. GilbertChang and Gatenio,Jeanneault, are independent under the NYSE rules.

In addition, we have determined that all of the members of our Board, except Messrs. GilbertChang and Gatenio,Jeanneault, are independent pursuant to the definition of independence in our charter, which is based on the definition included in the North American Securities Administrators Association, Inc.’s Statement of Policy Regarding Real Estate Investment Trusts, as revised and adopted on May 7, 2007. Our charter is available on our website at www.northstarsecurities.com/healthcarewww.NorthStarHealthcareReit.com under the heading “Investor Relations—Corporate Governance” and is also available without charge to stockholders upon written request to: NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: General Counsel.

Board Leadership Structure; Meetings of Independent Directors

Our Board believes it is important to select our Executive Chairman and our Chief Executive Officer in the manner it considers to be in our best interests and in the best interests of our stockholders at any given point in time. The members of our Board possess considerable business experience and in-depth knowledge of the issues we face, and are therefore in the best position to evaluate our needs and how best to organize our leadership structure to meet those needs. The Executive Chairman and the Chief Executive Officer positions may be filled by one individual or by two different individuals. Our Board currently operates under a leadership structure with separate roles for our Chairman of the Board and our Chief Executive Officer. Our company’s day-to-day operations are conducted by its officers under the direction of Mr. Jeanneault, our Chief Executive Officer, President and President.Vice Chairman. Our Board has selected Mr. GilbertChang to serve as our Executive Chairman of the Board based on his service with and knowledge of our company and his significant leadership and real estate experience. Mr. Jeanneault and Mr. GilbertChang work together to provide consistent communication and coordination for the Company, which our Board believes will result in effective and efficient implementation of our corporate strategy.

Although Mr. GilbertChang is not an independent director, our Board has determined that it is not necessary to appoint a lead independent director. To promote the independence of our Board and appropriate oversight of management, our independent directors meet in executive sessions at which only non-management directors are present. These meetings are held in conjunction with the regularly scheduled quarterly meetings of our Board, but may be called at any time by our independent directors. In 2016,2019, our independent directors met fivesix times in executive session without management present following Board meetings.

During the year ended December 31, 2016,2019, our Board met on nineseven occasions. Each director then serving attended at least 75% of the aggregate number of meetings of our Board.Board, except for Mr. Altobello.

Stockholder Communications with our Board

Our Board has established the following means for stockholders to communicate concerns to our Board. If the concern relates to our financial statements, accounting practices or internal controls, the concerns should be submitted in writing to the chairman of our Audit Committee at NorthStar Healthcare Income, Inc., 399 Park590 Madison Avenue, 18th34th Floor, New York, New York 10022, Attn: Secretary. If the concern relates to our governance practices, business ethics or corporate conduct, the concern may be submitted in writing to our Secretary at the above address. If uncertain as to which category a concern relates, a stockholder may communicate the concern to any of our independent directors in care of our Secretary at the address above. Communications received will be distributed by the Secretary to such member or members of our Board as deemed appropriate by the Secretary, depending on the facts and circumstances outlined in the communication received.

Director Nomination Procedures

We do not have a standing nominating committee. Our Board has determined that it is appropriate for us not to have a nominating committee because our Board as currently constituted permits all of our independent directors to consider all matters for which a nominating committee would be ordinarily responsible. Each member of our Board participates in the consideration of nominees. Our charter requires that our directors must have at least three years of relevant experience demonstrating the

8

knowledge and experience required to successfully acquire and manage the type of assets acquired by us and that at least one of our independent directors has three years of relevant real estate experience. While we do not have any other minimum qualifications with respect to nominees, our Board considers many factors in connection with each candidate, including judgment, integrity, diversity, prior experience, the value of the candidate’s experience relative to the experience of other board members and the candidate’s willingness to devote substantial time and effort to board responsibilities. Our Board does not have a formal written policy regarding the consideration of diversity in identifying director nominees. Nevertheless, consideration of diversity will continue to be an important factor in identifying and recruiting new directors.

Our Board will also consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In order to be considered by our Board, recommendations made by stockholders must be submitted within the timeframe required for director nominations by stockholders as provided in our bylaws. See “Stockholder Proposals and Director Nominations for 2018”the 2021 Annual Meeting” below. In evaluating the persons recommended as potential directors, our Board will consider each candidate without regard to the source of the recommendation and take into account those factors that our Board determines are relevant. Stockholders may directly nominate potential directors (without the recommendation of our Board) by satisfying the procedural requirements for such nomination as provided in Article II, Section 11, of our bylaws.

Risk Oversight

Risk is inherent with every business and how well a business manages risk can ultimately determine its success. Our management team is responsible for our risk exposures on a day-to-day basis by identifying the material risks we face, implementing appropriate risk management strategies that are responsive to our risk profile, integrating consideration of risk and risk management into our decision-making process and, if necessary, promulgating policies and procedures to ensure that information with respect to material risks is communicated to our Board. Our Board has the responsibility to oversee and monitor these risk management processes by informing itself of material risks and evaluating whether management has reasonable controls in place to address the material risks; our Board is not responsible, however, for defining or managing our various risks. Our Board is regularly informed by management of potential material risks and activities related to those risks at Board meetings. Our executive officers generally attend all Board meetings and management is readily available to the Board to address any questions or concerns raised by the Board on risk management and any other matters. Our Board’s oversight of risk has not specifically affected its leadership structure.

Director Attendance at Annual Meeting

Our corporate governance guidelines encourage but do not require our directors to attend the annual meeting of stockholders. All of our directors attendedserving at the time of our 20162019 annual meeting of stockholders.

stockholders attended the meeting.

EXECUTIVE OFFICERS

Our executive officers are elected annually by our Board and serve at the discretion of our Board. Set forth below is information, as of the date of this proxy statement, regarding our executive officers:

| Name | Age | Position | ||

| Ronald J. Jeanneault | Chief Executive Officer, President and | |||

| Douglas W. Bath | Chief Investment Officer | |||

| Frank V. Saracino | Chief Financial Officer and Treasurer | |||

| Ann B. Harrington | General Counsel and Secretary | |||

Set forth below is biographical information regarding each of our executive officers, other than Messrs. GilbertChang and Gatenio,Jeanneault, whose biographical information is provided above under “Current Directors Who are Nominees for Re-election.”

Douglas W. Bath. Douglas W. Bath has been our Chief Investment Officer since March 2012. From February 2009 to February 2012, Mr. Bath was Vice President and Group Head, Healthcare Finance for Walker & Dunlop, Inc., an NYSE-traded provider of commercial real estate financial services. Mr. Bath created and led the Senior Housing and Hospital lending division and grew its loan portfolio to $1.3 billion in 2011. From June 2006 to November 2008, Mr. Bath was Senior Vice President with Sunrise, where he oversaw development and recapitalization initiatives and guided asset management activities of Sunrise’s 448 facilities across 76 distinct portfolios and 36 equity investment companies. From April 2005 to June 2006, Mr. Bath was Vice President at JP Morgan Chase & Co., where he led its senior housing initiatives and played a key role in raising

9

and managing a $700 million equity fund. From August 2003 to April 2005, he was Senior Vice President of Sunrise and was responsible for development and recapitalization joint venture transactions. Previously, Mr. Bath served in various capacities in the investment group at Sunrise, where he transitioned from the operations department at Sunrise after beginning his career at Sunrise in 1995. Over the course of his career, Mr. Bath has been involved in over $6.5 billion of senior housing transactions. Mr. Bath holds a Bachelor of Arts from Virginia Polytechnic Institute and State University in Blacksburg, Virginia and a Master of Business Administration from the University of Pittsburgh in Pittsburgh, Pennsylvania.Pittsburgh.

Frank V. Saracino. Mr. Saracino has been our Chief Financial Officer and Treasurer since August 2015. Mr. Saracino has served as Managing Director, Chief Financial Officer - Retail Companies at the Sponsor since August 2015 and Chief Accounting Officer at Colony Credit Real Estate, Inc. since November 2018. In addition, Mr. Saracino has served as Chief FinancialExecutive Officer and Treasurer of each of NorthStar Income, NorthStar Income II and NorthStar/RXR since August 2015. Mr. Saracino has also served as the Chief Financial Officer and Treasurer of RE Capital Fund since December 2015President, and Chief Financial Officer and Treasurer of NorthStar CorporateCC Real Estate Income Fund since JulyFebruary 2020 and December 2015, respectively. Mr. Saracino has also served as Chief Financial Officer of N1 Liquidating Trust since February 2018. He previously served as Chief Financial Officer and NovemberTreasurer of NorthStar Income Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. from August 2015 respectively.through January 2018 and Chief Financial Officer of NorthStar/RXR New York Metro, Inc. from August 2015 through January 2018. Prior to joining NSAM (now Colony NorthStar) in 2015,NorthStar Asset Management Group, Inc. (NSAM) from July 2012 to December 2014, Mr. Saracino was with Prospect Capital Corporation, or Prospect, where he concentratedserved as a managing director concentrating on portfolio management, strategic and growth initiatives and other management functions. In addition, during his tenure at Prospect, Mr. Saracino served as Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary of each of Priority Income Fund, Inc. and Pathway Energy Infrastructure Fund, Inc., and their respective investment advisers, and served as a Managing Director of Prospect Administration, LLC. Previously, Mr. Saracino was a Managing Director at Macquarie Group, and Head of Finance from August 2008 to June 2012 for its Americas non-traded businesses which included private equity, asset management, lease financing, private wealth, and investment banking. From 2004 to 2008, he served first as Controller and then as Chief Accounting Officer of eSpeed, Inc. (now BGC Partners, Inc.), a publicly-traded subsidiary of Cantor Fitzgerald. Prior to that, Mr. Saracino worked as an investment banker at Deutsche Bank advising clients in the telecom industry. Mr. Saracino started his career in public accounting at Coopers & Lybrand (now PricewaterhouseCoopers) where he earned a CPA and subsequently worked in internal auditing for The Dun & Bradstreet Corporation. Mr. SaracinoHe holds a Bachelor of Science in Accountingdegree from Syracuse University.

Ann B. Harrington. Ms. Harrington has been our General Counsel and Secretary since May 2016. Ms. Harrington also servespreviously served as the General Counsel and Secretary of NorthStar/RXR, a position she has held sincefrom February 2017.2017 through October 2018. In addition, Ms. Harrington currently serves as Senior Vice President, AssociateManaging Director, Deputy General Counsel of Colony NorthStar,our Sponsor, a position she has held since March 2019, and previously served as Senior Vice President, Deputy General Counsel since January 2017 and previously served as Senior Corporate Counsel of NSAM (now Colony NorthStar)Capital) from January 2015 to January 2017. Prior to joining NSAM, Ms. Harrington served as an associate in the Corporate and Financial Services Group of Willkie Farr & Gallagher LLP from September 2008 through December 2014, where she advised public and private corporate clients with respect to capital markets transactions, mergers and acquisitions, securities laws compliance, corporate governance and other general corporate matters. Ms. Harrington holds a Bachelor of Arts from Princeton University in Princeton, New Jersey and a Juris Doctor from The Ohio State University Moritz College of Law in Columbus, Ohio.Law.

EXECUTIVE COMPENSATION

We currently have no employees. Our day-to-day management functions are performed by our Advisor and related affiliates. Our executive officers are all employees of our Sponsor or its affiliates and are utilized by our Advisor to provide management, acquisition, advisory and certain administrative services for us. We do not pay any of these individuals for serving

in their respective positions. See “Certain Relationships and Related Transactions” below for a discussion of fees paid to our Advisor and other affiliated companies.

DIRECTOR COMPENSATION

Independent Directors

Pursuant to ourthe Third Amended and Restated NorthStar Healthcare Income, Inc. Independent Directors Compensation Plan, or the Independent Directors Plan, each of our independent directors was paid an annual director’s fee of $85,000$110,000 in 2016.2019. In addition, Mr. Jack F. Smith, Jr., who serves as our Audit Committee chairperson, was paid an additional fee of $30,000 and each other member of our Audit Committee was paid an additional annual fee of $15,000 in 2016. In addition, each2019. Each of our independent directors also received $40,000$60,000 in shares of restricted common stock in June 2016,2019, in connection with such independent director’s re-election to our Board. TheBoard, or, in the case of Mr. T. Andrew Smith, $65,000 in shares of restricted common stock generally vests quarterly over two years; provided, however, thatupon his initial appointment to the restricted common stock will become fully vested onBoard in December 2019.

Pursuant to the earlier occurrence of: (i) the termination of the independent director’s service as a director due to his or her death or disability; or (ii) a change in our control. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on our Board.

10

in shares of restricted common stock. The actual number of shares of restricted stock that we grant is determined by dividing the fixed value by (i) prior to a listing of our shares on a national securities exchange, or a Listing, and during ana public offering, the offering price to the public, (ii) prior to a Listing and following ana public offering, the most recently disclosed net asset value, or NAV, or if a NAV has not been disclosed, the most recent offering price or (iii) following a listing on a national securities exchange,Listing, the closing price of the shares on the date of grant. The shares of restricted common stock will generally vest quarterly over two years; provided, however, that the restricted common stock will become fully vested on the earlier occurrence of: (i) the termination of the independent director’s service as a director due to his or her death or disability; or (ii) a change in our control. We reserve the right to modify the nature of the equity grant to our directors from restricted common stock to other forms of stock-based incentive awards, such as units in our operating partnership structured as profit interests, as well as the vesting terms and schedule.

Directors who are our officers, including our Executive Chairman and Vice Chairman, do not receive compensation as directors.

Director Compensation for 20162019

The following table provides information concerning the compensation of our independent directors for 2016.2019.

| Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Total | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Total | ||||||||||||||||||

| Daniel J. Altobello | $ | 85,000 | $ | 40,000 | $ | 125,000 | ||||||||||||||||||

Daniel J. Altobello(3) | $ | 114,583 | $ | 60,000 | $ | 174,583 | ||||||||||||||||||

| Gregory A. Samay | 85,000 | 40,000 | 125,000 | 125,000 | 60,000 | 185,000 | ||||||||||||||||||

| Jack F. Smith, Jr. | 100,000 | 40,000 | 140,000 | 140,000 | 60,000 | 200,000 | ||||||||||||||||||

T. Andrew Smith(3) | 10,417 | 65,000 | 75,417 | |||||||||||||||||||||

| Total | $ | 270,000 | $ | 120,000 | $ | 390,000 | $ | 379,583 | $ | 245,000 | $ | 635,000 | ||||||||||||

________________________

| (1) | Amounts include annual cash retainers. Fees paid to directors are currently incurred by our Advisor on our behalf and are classified as operating costs to the extent permitted by the 2%/25% Guidelines (as defined herein). See “Certain Relationships and Related Transactions.” |

| (2) | Reflects shares issued at a price of |

| (3) | Mr. Altobello resigned in November 2019 and Mr. T. Andrew Smith was appointed to fill the resulting vacancy in December 2019. The table above reflects their respective prorated annual cash retainers. |

In addition, we reimbursed all directors for reasonable out-of-pocket expenses incurred in connection with their services on our Board in 2016.2019.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 11, 2017,8, 2020, the total number and the percentage of shares of our common stock beneficially owned by:

each of our directors and each nominee for director;

each of our executive officers; and

all of our directors and executive officers as a group.

The following table also sets forth how many shares of our common stock are beneficially owned by each person known to us to be a beneficial owner of more than 5% of the outstanding shares of our common stock. As of April 11, 2017,8, 2020, there were no beneficial owners of more than 5% of our outstanding common stock. The percentages of common stock beneficially owned are based on 186,562,177189,191,862 shares of our common stock outstanding as of April 8, 2020.

11 2017.

Amount and Nature of Beneficial Ownership(1) | ||||||

| Name and Address of Beneficial Owner | Number | Percentage | ||||

Directors and Executive Officers(2): | ||||||

| — | — | |||||

| — | — | |||||

Daniel J. Altobello(3)(4) | * | |||||

Gregory A. Samay | * | |||||

Jack F. Smith, Jr. | * | |||||

T. Andrew Smith(3)(4) | ||||||

| Douglas W. Bath | — | — | ||||

| Frank V. Saracino | — | — | ||||

| — | — | |||||

| All directors and executive officers as a group | * | |||||

________________________

| * | Less than one percent. |

| (1) | Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares: (i) “voting power,” which includes the power to vote or to direct the voting of such security; or (ii) “investment power,” which includes the power to dispose of or direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities which that person has a right to acquire within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of securities as to which he or she has no economic or pecuniary interest. |

| (2) | The address of each of the directors and executive officers is |

| (3) | Mr. Altobello resigned as a member of our Board in November 2019 and Mr. T. Andrew Smith was appointed by our Board to fill the resulting vacancy in December 2019. |

| (4) | Includes |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides summary information on the securities issuable under our equity compensation plans as of December 31, 2016.2019.

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants, and Rights | Weighted- Average Exercise Price of Outstanding Options, Warrants, and Rights | Number of Securities Remaining Available for Future Issuance | ||||

Equity Compensation Plans Approved by Stockholders(1) | — | — | |||||

| Equity Compensation Plans Not Approved by Stockholders | N/A | N/A | N/A | ||||

| Total | — | — | |||||

________________________

| (1) | We have adopted two equity compensation plans: |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following section describes all transactions and currently proposed transactions between us and any related person since January 1, 20152018 and such related person had or will have a direct or indirect material interest. Our independent directors are specifically charged with and have examined the fairness of such transactions to our stockholders and have determined that all such transactions are fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties.

12

Ownership Interests

Pursuant to the limited partnership agreement of our operating partnership, NorthStar Healthcare Income OP Holdings, LLC, an affiliate of our Advisor, or the Special Unit Holder, holds a subordinated participation interest entitling it to receive distributions equal to 15% of our net cash flows, whether from continuing operations, the repayment of loans, the disposition of assets or otherwise, but only after our stockholders have received, in the aggregate, cumulative distributions equal to their invested capital plus a 6.75% cumulative, non-compounded annual pre-tax return on such invested capital. Through our Sponsor’s joint venture with James F. Flaherty III, our former Vice Chairman, Mr. Flaherty is entitled to receive one-third of the distributions received by the Special Unit Holder. In addition, the Special Unit Holder is entitled to a separate payment if it redeems its special units. The special units may be redeemed upon: (i) the listing of our common stock on a national securities exchange; or (ii) the occurrence of certain events that result in the termination or non-renewal of our advisory agreement, in each case for an amount that the Special Unit Holder would have been entitled to receive had our operating partnership disposed of all of its assets at the enterprise valuation as of the date of the event triggering the redemption. If the event triggering the redemption is: (i) a listing of our shares on a national securities exchange, the enterprise valuation will be calculated based on the average share price of our shares for a specified period; or (ii) an underwritten public offering, the enterprise value will be based on the valuation of the shares as determined by the initial public offering price in such offering. If the triggering event is the termination or non-renewal of the advisory agreement other than for cause, the enterprise valuation will be calculated based on an appraisal of our assets.

To date, we have not paid any distributions to the Special Unit Holder pursuant to its subordinated participation interest.

Pursuant to a distribution support agreement, NorthStar Realty committed to purchase up to an aggregate of $10.0 million in shares of our common stock (including any contributions made by NorthStar Realty to us to satisfy the minimum offering requirement in our initial public offering) in certain circumstances during our offering in order to provide, among other matters, additional cash to pay distributions, if necessary. On February 11, 2013, an affiliateAs of December 31, 2018, NorthStar Realty had purchased 222,223610,339 shares of our common stock for $2.0$5.5 million at $9.00 per share (reflecting that no selling commissions or dealer manager fees were paid) to satisfy our minimum offering requirement in our initial public offering. We usedunder the proceeds from such sale to make a capital contribution to our operating partnership. As of December 31, 2016,distribution support agreement, including the purchase of shares to satisfy the minimum offering requirement, NorthStar Realty purchased 588,116 shares of our common stock for $5.3 million under such commitment.requirement. As our primary offering in our follow-on offering has been completed, NorthStar Realty has no further obligation to purchase shares under the distribution support agreement.

In addition, our Advisor has been issued an additional 2,838,996 shares of our common stock under our advisory agreement as of April 8, 2020 as partial payment of our Advisor’s asset management fee as described in further detail below.

Advisor

Our Advisor provides management, acquisition, advisory and certain administrative services for us, subject to oversight by our Board. Our Advisor is an indirect subsidiary of our Sponsor. All of our officers are employees of our Sponsor or its affiliates.

We pay our Advisor the following pursuant to the advisory agreement:

For substantial assistance in connection with the sale of investments and based on the services provided, our Advisor, or its affiliates, may receive a disposition fee equal to 1.0% of the contract sales price of each debt investment sold and 2.0% of the contract sales price of each property sold. We do not pay a disposition fee upon the maturity, prepayment, workout, modification or extension of a debt investment unless there is a corresponding fee paid by our borrower, in which case the disposition fee is the lesser of: (i) 1.0% of the principal amount of the debt investment prior to such transaction; or (ii) the amount of the fee paid by our borrower in connection with such transaction. If we take ownership of a property as a result of a workout or foreclosure of a debt investment, we will pay a disposition fee upon the sale of such property. ForWe did not incur any disposition fees for the years ended December 31, 20162019 and December 31, 2015, our Advisor incurred $0.1 million and $0.1 million, respectively, in disposition fees.2018.

Our Advisor, or its affiliates, are entitled to receive reimbursement for direct and indirect operating costs incurred by our Advisor in connection with administrative services provided to us. Indirect operating costs include our allocable share of costs incurred by our Advisor for personnel and other overhead such as rent, technology and utilities. However, there is no reimbursement for personnel costs related to (1) our executive officers and (2) with respect to other personnel, to the extent allocable to activities performed by such personnel for which our Advisor

13

receives an acquisition fee or disposition fee. We reimburse our Advisor quarterly for operating costs (including the asset management fee), subject to a limitation that operating costs for the four preceding fiscal quarters not exceed the greater of: (i) 2.0% of our average invested assets; or (ii) 25.0% of our net income determined without reduction for any additions to reserves for depreciation, loan losses or other similar non-cash reserves and excluding any gain from the sale of assets for that period, or the 2%/25% Guidelines. Notwithstanding the above, we may reimburse our Advisor for expenses in excess of this limitation if a majority of our independent directors determines that such excess expenses are justified based on unusual and non-recurring factors. We calculate the expense reimbursement quarterly based upon the trailing 12-month period. As a result, for the years ended December 31, 20162019 and 2015,2018, we incurred $23.7$11.9 million and $19.3$12.6 million, respectively, of allocable operating costs and we paid $23.5$11.6 million and $19.4$9.7 million, respectively, in operating costs to our Advisor. In addition, as of December 31, 2016,2019, our Advisor incurred no operating costs on our behalf that are still allocable.

Our Advisor, or its affiliates, was entitled to receive reimbursement for organization and offering costs paid on our behalf in connection with our offerings. We are obligated to reimburse our Advisor, or its affiliates, as applicable, for organization and offering costs to the extent the aggregate of selling commissions, dealer manager fees and other organization and offering costs do not exceed 15.0% of gross proceeds from our primary offerings. Our Advisor did not expect reimbursable organization and offering costs, excluding selling commissions and dealer manager fees, to exceed $22.5 million, or 1.5% of the total proceeds available to be raised from our offerings. For the years ended December 31, 20162019 and 2015,2018, we incurred $0.4 million and $5.0 million, respectively, of allocable organization and offering costs. In addition, as of December 31, 2016 and 2015, our Advisor incurred no organization and offering costs and an immaterial amount in organization and offering costs, respectively, on our behalf that are still allocable. Our independent directors did not determine that any of the organization and offering costs were unfair and commercially unreasonable.costs.

We reimburse our Advisor for actual costs incurred in connection with the selection, origination or acquisition of an investment, whether or not we ultimately originate or acquire the investment. For the years ended December 31, 20162019 and 2015,2018, we had no acquisition expenses reimbursable acquisition expenses.to our Advisor.

Subject to the terms and conditions of the advisory agreement, we also agreed to indemnify our Advisor and its affiliates against losses it incurs in connection with its obligations under the advisory agreement.

Real Estate Investments

In December 2015, we, through a joint venture with Griffin-American Healthcare REIT III, Inc., or GAHR3, a non-traded REIT sponsored and advised by American Healthcare Investors, LLC, or AHI, acquired a 29%29.0% interest in the Trilogy portfolio, a $1.2 billion healthcare portfolio and contributed $202$201.7 million in cash.for our interest. The purchase was approved by our board of directors, including all of our independent directors. In June 2016 and 2017, we funded additional capital contributions of $18.8 million and $8.3 million, respectively, in accordance with the joint venture agreement,agreement. Additionally, in 2018 and 2019, we funded an additional capital contributioncontributions of $18.8$4.5 million and $2.4 million, respectively, for a total contribution of $220.5$189.0 million. The additional fundingfundings related to certain business initiatives, including the acquisition of additional senior housing and skilled nursing facilities and repayment of certain outstanding obligations.

In March 2016,October 2018, we completed the acquisitionsold 20.0% of NorthStar Realty’s 60%our ownership interest in the Winterfell portfolio forTrilogy joint venture, which generated gross proceeds of $48.0 million and reduced our ownership interest in the joint venture from approximately 29% to 23%. We sold the ownership interest to a purchase price of $537.8 million, excluding escrows and subject to customary prorations and adjustments. We funded the acquisition with approximately $142.9 million of equity, plus closing costs and assumed NorthStar Realty’s 60% sharewholly owned subsidiary of the outstanding borrowingsoperating partnership of Griffin-American Healthcare REIT IV, Inc., a non-traded REIT sponsored and advised by AHI.

Credit Facility

In October 2017, we obtained a revolving line of credit from an affiliate of Colony Capital, for up to $15.0 million at an interest rate of 3.5% plus LIBOR, or our Sponsor Line, with an aggregate principal amountinitial term of approximately $648.2one year, plus a six-month extension option to provide additional short-term liquidity. In November 2017, the borrowing capacity under the Sponsor Line was increased to $35.0 million. In March 2018, the Sponsor Line was further amended to extend the term to December 2020 and add additional events of default to conform to our revolving credit facility with Key Bank. In May 2019, the Sponsor Line was further amended to extend the term to December 2021. As of April 8, 2020, we had no borrowings outstanding under the Sponsor Line.

Policies Governing Related Person Transactions

In order to reduce or eliminate certain potential conflicts of interest, our charter and our advisory agreement contain restrictions and conflict resolution procedures relating to transactions we enter into with our Sponsor, our Advisor, our directors or their respective affiliates. The types of transactions covered by these policies include the compensation paid to our Advisor, decisions to renew our advisory agreement, acquisitions or leases of assets, mortgages and other types of loans and any other transaction in which our Sponsor, our Advisor or any of our directors have an interest, reimbursement of operating expenses in excess of the 2%/25% Guidelines, issuances of options and warrants to and repurchases of shares.shares from our Advisor, Sponsor, directors or any of their affiliates. Under the restrictions, these transactions, if permitted, must be approved by a majority of our directors, including a majority of our independent directors, not otherwise interested in such transaction.

14